Many New Jersey parents breathed a sigh of relief upon receiving their Child Tax Credit Payments in late 2021. Our new report at the Rutgers Center for Women and Work, in partnership with the New Jersey State Policy Lab, finds most low-income parents spent the money on essentials like food, utilities, clothing, and rent.

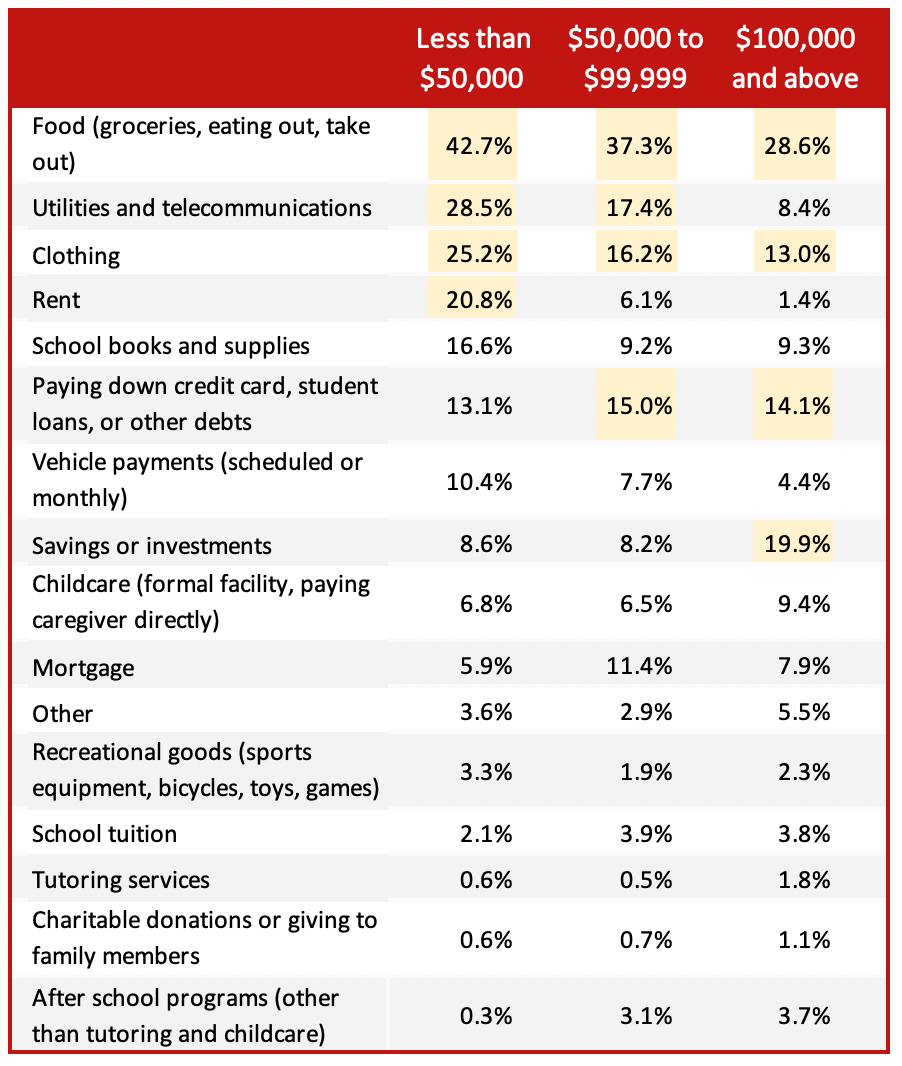

Using Household Pulse Survey data, we find that nearly 43% of New Jersey families with household incomes less than $50,000 indicated they spent at least some of their Child Tax Credit Payments on food. With high levels of reported food insecurity in the state throughout the pandemic, this finding is especially encouraging. Families with higher household incomes also commonly indicated they spent their tax credits on food (29%), while many indicated they were able to save some of the payments (20%) or use them to pay down debt (14%).

Use of Child Tax Credit by income, 2021

Note: Aggregated over respondents from survey weeks 34-40 (July to December 2021), sample limited to New Jersey households that indicated receipt of Child Tax Credit payments.

Source: Rutgers University’s Center for Women & Work analysis of survey-weighted Household Pulse Survey data

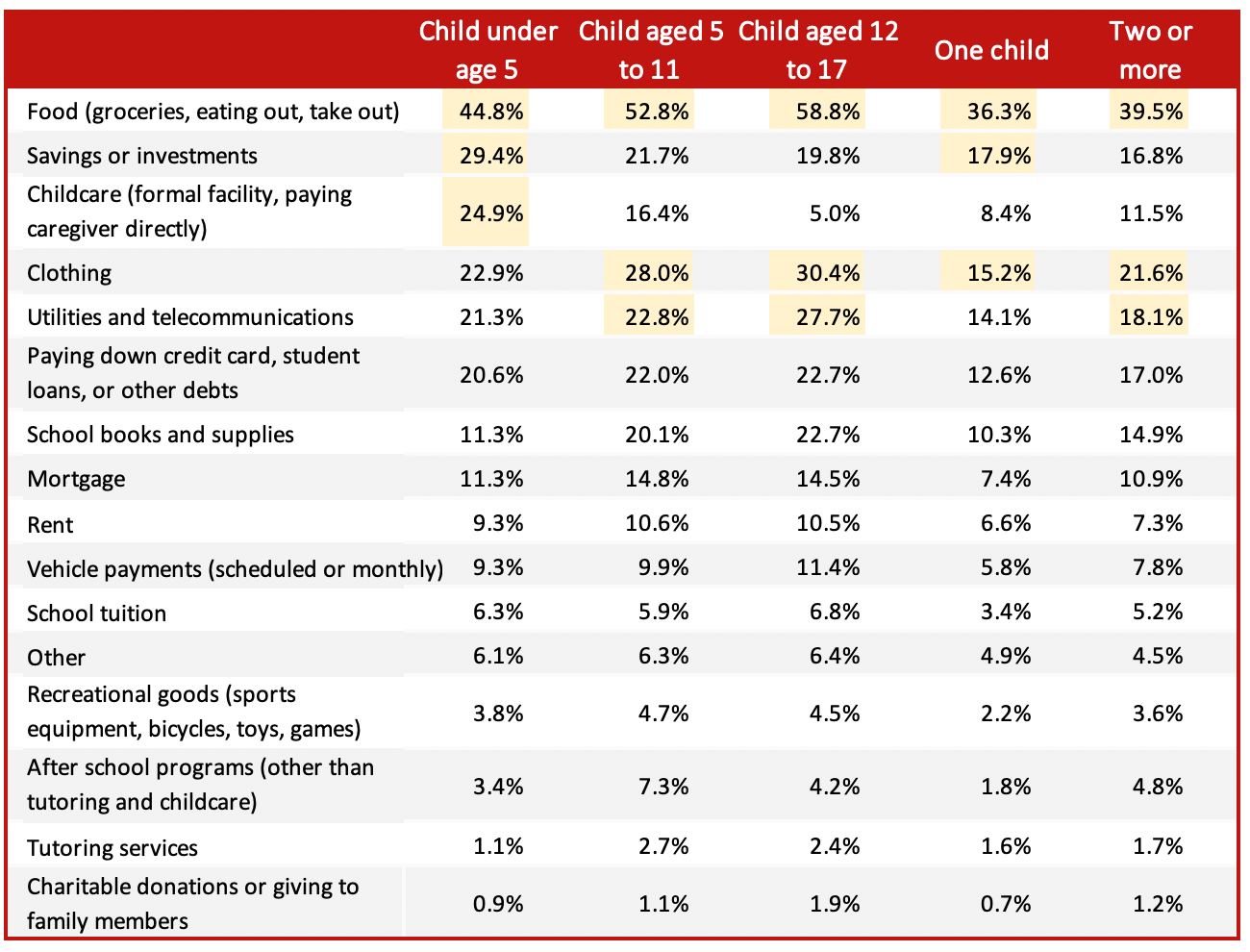

The data also highlight the harsh realities many parents have faced during the COVID childcare crisis. New Jersey families with young children were substantially more likely to have spent some of their payments on childcare. In fact, one-quarter of parents with a child under age 5 (25%) spent at least part of the money on childcare.

The fact that so many parents of young children used the payments on childcare raises a red flag. Without financial support or vast improvements in the state’s childcare infrastructure, many of these families will continue to struggle.

Child Tax Credit spending by number of children and their age, 2021

Note: Aggregated over respondents from survey weeks 34-40 (July to December 2021), sample limited to New Jersey households that indicated receipt of Child Tax Credit payments.

Source: Rutgers University’s Center for Women & Work analysis of survey-weighted Household Pulse Survey data

The advanced Child Tax Credit payments were an especially meaningful policy for the state’s lowest income households who struggle to meet basic needs. The Child Tax Credit literally helps lift families out of poverty which benefits children and society, but not if the payments don’t reach the households who need it the most.

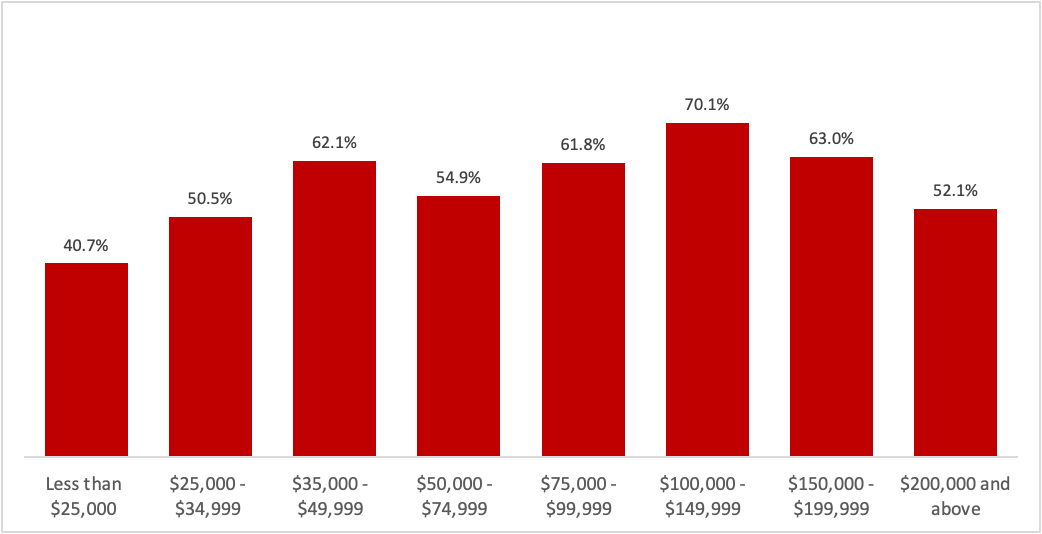

In New Jersey, low-income households with children were among the least likely to have reported they received the credit. For instance, among respondents with household incomes less than $25,000 and children in the household, just 40.7% indicated they had received payments. Yet among families with household incomes of $100,000 to$149,999, 70% indicated they had received the payments.

Households that received Child Tax Credit payments, by income, 2021

Note: Aggregated over respondents from survey weeks 34-40 (July to December 2021), sample limited to New Jersey households with children.

Source: Rutgers University’s Center for Women & Work analysis of survey-weighted Household Pulse Survey data

This result is consistent with national-level findings on Child Tax Credit receipt.[1] Many low-income households do not file taxes, and receipt of the payments required either (1) filing of 2019 and 2020 taxes or (2) claiming an economic impact payment through the IRS’s non-filer tool. Ultimately, if we want New Jersey’s lowest income families to benefit from the Child Tax Credit programs, more needs to be done by way of outreach and tax preparation assistance.

The Center for Women and Work is partnering with the New Jersey State Policy Lab to continue envisioning solutions to the problems low-income children in New Jersey face and to consider how the Child Tax Credit might be expanded to help more of the Garden State’s neediest families.

References:

[1] Karpman, M., Maag, E., Kenney, G. M., & Wissoker, D. A. (2021). Who Has Received Advance Child Tax Credit Payments, and How Were the Payments Used? Washington, DC: Urban Institute. https://www.urban.org/sites/default/files/publication/105023/who-has-received-advance-ctc-payments-and-how-were-the-payments-used_0.pdf