The School Reform Funding Act of 2008 (SRFA) was designed to create a new school funding formula to end a long cycle of failed legislative attempts to reduce school spending inequalities across the state. Interestingly, the SRFA created its own revenue inequalities through the provision of “adjustment” aid to school districts. The motivation for distributing adjustment aid was that some school districts would receive less state funding compared to the total state funding they received prior to the SRFA. State officials feared this would create short-term budgetary shocks to those school districts. As a result, the SRFA provided temporary additional state funding assistance through the provision of adjustment aid to approximately 300 New Jersey school districts. However, this temporary funding was not temporary, and some school districts continued for years to receive more state funding than was required under the SRFA. For example, during the 2016-17 school year, the average New Jersey school district received approximately $1.8 million in adjustment aid, which accounted for 13% of its total state funding.

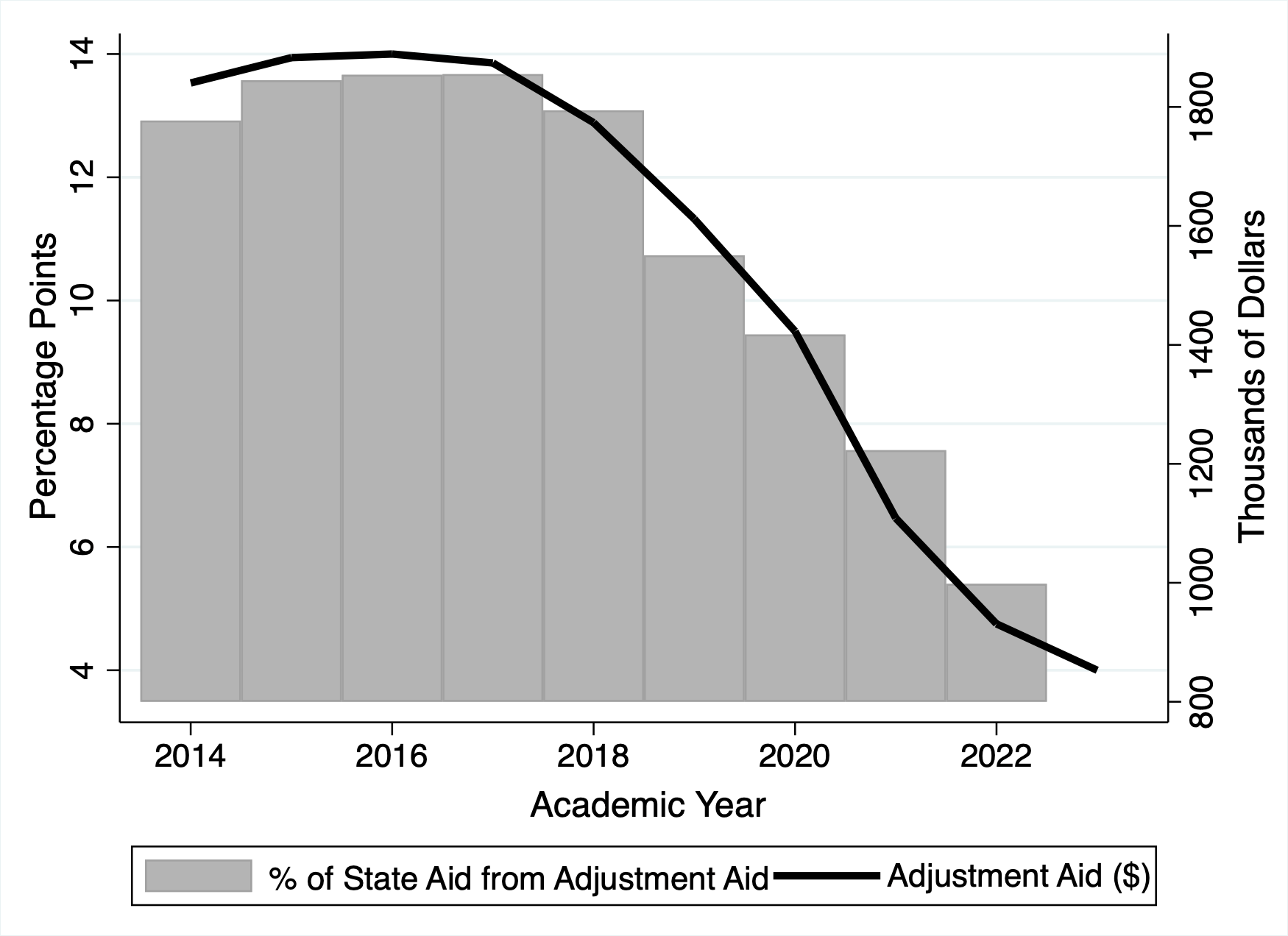

Figure 1. Changes in the Adjustment Aid Over Time for the Average New Jersey School District

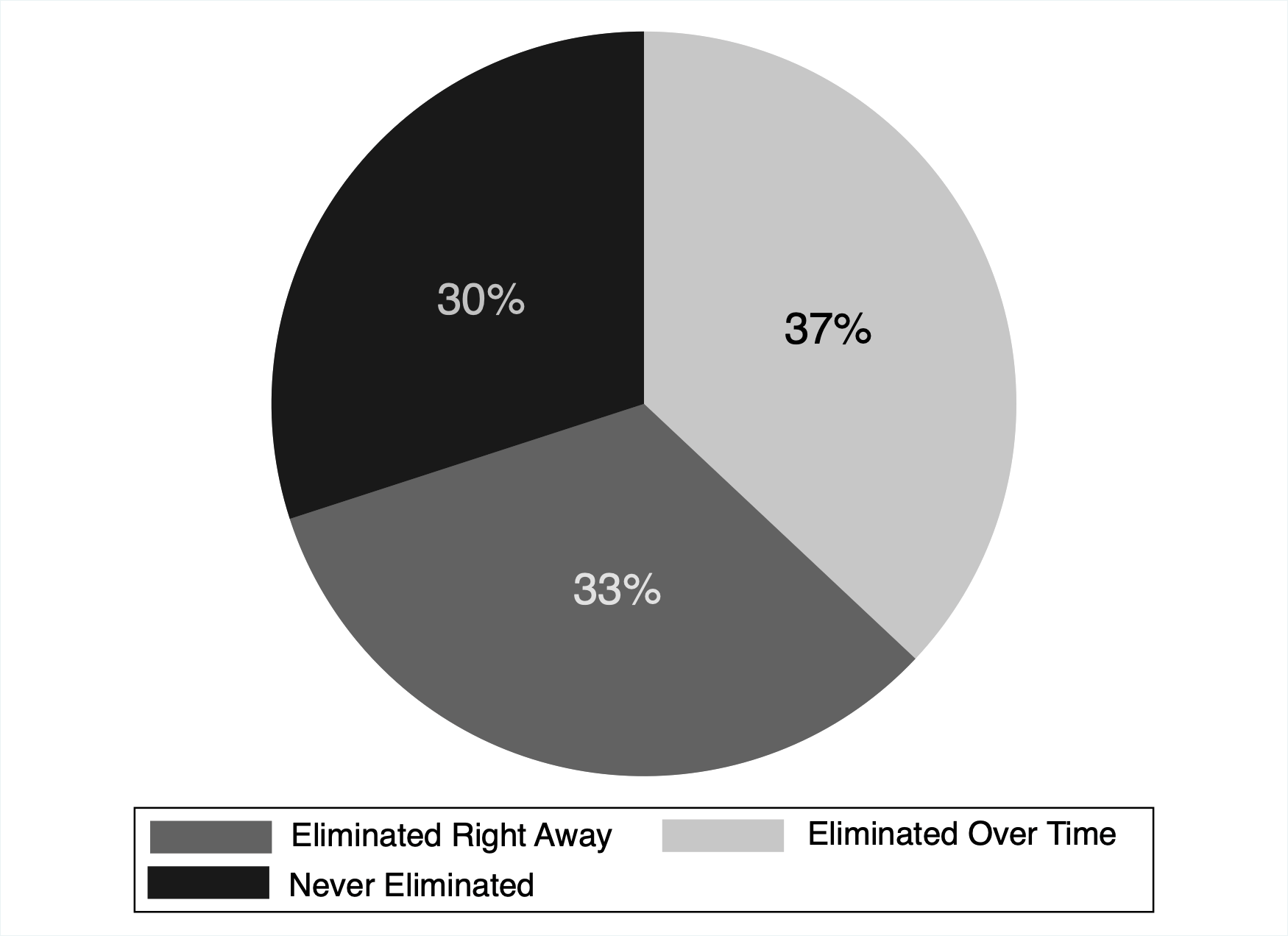

The 2018 New Jersey S-2 Bill was designed to eliminate the provision of adjustment aid and make other adjustments to the school aid formula. Specifically, the S-2 bill started the process of eliminating adjustment aid for a portion of school districts starting in the 2018-19 school year. Figure 1 above illustrates the changes in adjustment aid for the average school district. Adjustment aid for the average school district went from $1.8 million (13% of its total state funding) during the 2013-14 school year to less than a $1 million (less than 4% of its total state funding) by the 2022-23 school year. As shown in Figure 2, of the approximately 300 school districts that received adjustment aid starting in the 2008-09 school year, approximately 33% of them had their adjustment aid eliminated right away in the 2018-19 school year, 37% of them had their adjustment aid eliminated some time before the 2022-23 school year, and about 30% of them are still receiving an average of $2.8 million in adjustment aid (11% of its total state funding) as of the 2022-23 school year. This is suggestive evidence that the S-2 bill has had an important impact on the distribution of state aid across the school districts. Therefore, it is vital for policymakers to be aware of the kinds of school districts that were made worse off by the elimination of adjustment aid, and how the elimination of adjustment aid impacted both school districts’ fiscal decisions and student performance.

Figure 2. Adjustment Aid Outcomes for School Districts Following the Passage of the S-2 Bill

My research project first investigates the differences between those New Jersey school districts that never received adjustment aid, those school districts that saw their adjustment aid eliminated after the passage of the S-2 bill, and lastly, those school districts that still receive adjustment aid as of the 2022-23 school year. Moving forward, my research project will also explore the short-term impact of these reductions in school aid on school districts’ fiscal decisions and student test scores. Specifically, I will examine whether school districts responded to reductions in school aid by raising more local revenue, or by making spending cuts. If there were spending cuts, it is possible that this would result in less educational resources for students. Therefore, I will explore if there is any evidence that student academic performance declined following these reductions in school aid.

A full policy report with finalized results and policy recommendations is expected to be published by the New Jersey State Policy Lab in the spring of 2023.

Michael S. Hayes, Ph.D. is an Associate Professor in the Department of Public Policy & Administration at Rutgers University-Camden.