Inflation has found its way to the front pages of newspapers for the first time in decades. From New Jersey’s perspective though, national reports of inflation are greater than those for New Jersey. From September 2020 to September 2021, core prices[1] increased by 4.0% nationwide but by just 2.5% in the New York metro area. In the Philadelphia metro area, core prices rose by 4.1% over the year preceding August 2021. Weighting the price rises in the two metro areas by their populations suggests core prices in New Jersey rose by about 3.0% during the year ending September 2021. This compares with a long-term trend for the nation and state of about 2.0% annual inflation. Most of the core price bump in all three geographies occurred during the brief five-month period from February through June 2021.

Some of the price rises within New Jersey compensate for unusually small price changes the year prior as the pandemic hit the area. Recall that New Jersey was among the first states to suffer from the COVID-19 virus.

When prices for food and energy products are weighed in, however, inflation was substantially higher. Including these items, prices rises were 5.4%, 3.8%, and 4.6% for the U.S., New York metro area, and Philadelphia metro area, respectively (and about 4.0% for the State of New Jersey). Prices of energy commodities account for the lion’s share of the gap in the rise between core and total average prices. Since September 2020, electricity prices rose 5.6%, natural gas prices at 16%, and gasoline prices at 42.7%. Energy-related price rises, however, mostly struck prior to April 2021.

From April to June 2021, vehicle sales—both used and new—had particularly large increases in prices. Consumer Reports[2] notes the vehicle price jump largely arose from a shortage of available new cars and light trucks. The same article notes that shortage was so serious that used car prices actually rose faster than those for new cars (25.0% versus 12.6% over the year ending September 2021, according to the U.S. BLS). The vehicle shortage was largely instigated by supply chain issues related to the pandemic that caused a global scarcity of semiconductors. All cars are now built with a plethora of microchips that control everything from window motors to navigation systems, so a chip shortage causes production slowdowns.

The above seems to suggest that energy prices and chip shortages, both global concerns, are the prime causes of inflation. If so, then why all of the hubbub about labor shortages? Certainly, because of the pandemic, retirement became more appealing for various reasons[3]—e.g., family caretaking, unusual workplace demands, and surprising adaptation to increased home life—and fewer immigrants crossed international borders. In fact, Kathryn Dill of The Wall Street Journal chalks up the hubbub to job switching within industries and areas of the U.S. most affected by the pandemic.[4]

Certain industries are churning more workers than others. People left healthcare, retail and food services at especially high rates at the end of the summer. Workers also left jobs at an accelerating pace across the Midwest and South. Texas and Florida have a high concentration of the industries seeing the greatest churn, including travel and hospitality. … Resignations among those firms were up between 53% and 57% over the same period last year for workers with every length of tenure, up to 15 years, the research showed. Workers between 40 and 50 years old, who are typically less likely to quit their jobs than younger employees, also quit in higher numbers this year, increasing their resignation rates by over 38%, the [Visier, Inc.] study found.

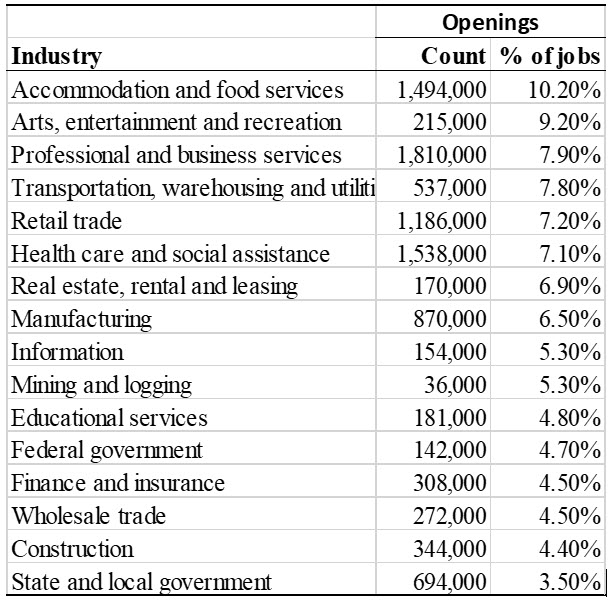

Still, there is clearly a job mismatch of sorts with some 10.4 million positions reported nationwide via the US BLS’s Job Openings and Labor Turnover Survey (JOLTS) as unfilled while some 8.4 million people continue to search for a job. When national JOLTS numbers are sorted by the share of openings, pandemic affected industries dominate the top spots (see Table 1). Only total JOLTS numbers are available for New Jersey, not industry-wide. They suggest that at the end of August 2021 the share of jobs open in New Jersey was slightly higher than that nationwide, 6.9% versus 6.6%, down from 7.5% and 7.0% in July.

Table 1. Job Openings by Industry, August 2021

Source: Job Openings and Labor Turnover Survey, U.S. Bureau of Labor Statistics.

Labor shortages have certainly pushed wages upward. In fact, nationwide, wages shot up rather quickly from April through September, 2021. According to the US BLS, worker compensation soared 1.5% from June to September after increasing 0.9% from April to June. It rose 4.2% since June 2020. This compares with 3.7% for the New York metro area and 3.3% in greater Philadelphia, which pegs wage inflation at about 3.6% for New Jersey statewide. Despite the increase, labor is clearly not the driving force behind much of the inflation we have seen.

Rather, over the past year, inflation has mostly been motivated by global energy price rises and global supply chain issues. In this vein, not only is New Jersey at no particular competitive disadvantage but neither is the nation. It does hurt our wallets, nonetheless, especially since our paychecks and unemployment checks are unable to keep pace with these global pressures.

Federal Reserve Chair Jerome Powell recently said “Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors.” [5] This suggests an interest-rate increase will wait until the second half of 2022 or until the economy returns employment to pre-pandemic levels.

Parting words from a two-handed economist… On one hand, the supply-chain issues are transitory and, thus, should eventually be resolved and taper off as an inflationary pressure. That is, 4.0% inflation is unsustainable. On the other hand, rising federal debt will eventually come home to roost in the form of interest payments via bonds and the like. That is, our nation will work, even more, via a buy-now-and-pay-later plan. This suggests that long-run inflation will likely climb from pre-pandemic levels around 2.0% annually to something more like 2.5%.

References

[1] Prices reported in this report are from the CPI-U of the U.S. Bureau of Labor Statistics, October 13, 2021 available online in November 2021 from https://www.bls.gov/regions/news-release-finder.htm?states=NJ.

The inflation of core prices does not include price changes for food and energy.

[2] Preston, Benjamin. (2021). “How to Navigate Surging Used Car Prices.” Consumer Reports, October 3, available online in November 2021 from https://www.consumerreports.org/buying-a-car/when-to-buy-a-used-car-a6584238157/

[3] Omeokwe, Amara. (2021). “Covid-19 Pushed Many Americans to Retire. The Economy Needs Them Back,” The Wall Street Journal, October 31, available online in November 2021 from https://www.wsj.com/articles/covid-19-pushed-many-americans-to-retire-the-economy-needs-them-back-11635691340

[4] Dill, Kathryn. (2021). “America’s Workers Are Leaving Jobs in Record Numbers, The Wall Street Journal, October 15, available online in November 2021 from https://www.wsj.com/articles/whats-driving-americas-workers-to-leave-jobs-in-record-numbers-11634312414

[5] Torres, Craig. (2021). “Fed to start tapering asset buys by $15 billion later this month,” Financial Post, November 3, available online in November 2021 https://financialpost.com/news/economy/fed-to-start-tapering-asset-buys-by-15-billion-later-this-month