The American Rescue Plan Act’s Coronavirus State and Local Fiscal Recovery Funds (ARPA-SLFRF) represent one of the most significant federal investments in state and local governments in history. Enacted in March 2021 as part of the broader $1.9 trillion American Rescue Plan, the ARPA-SLFRF allocated $350 billion in direct aid to state, local, tribal, and territorial governments. These funds were designed to provide critical support to governments as they navigated the public health and economic challenges of the COVID-19 pandemic. Allocations were made based on population size, with additional adjustments for tribal governments and territories to ensure equitable distribution.

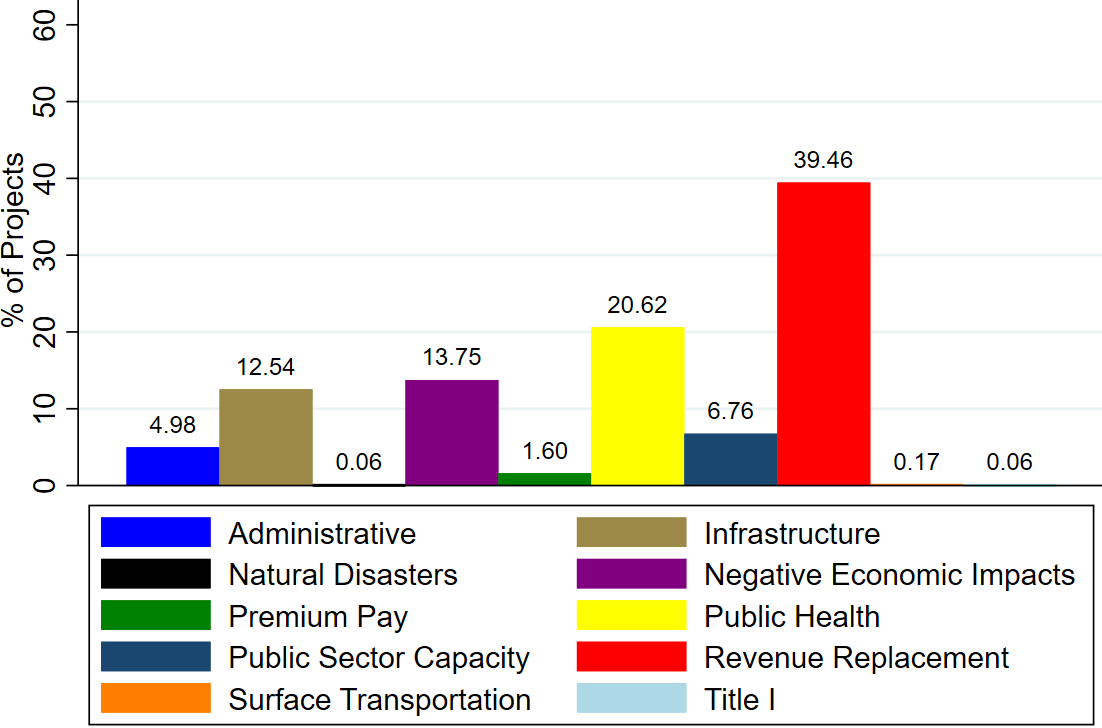

State and local governments were granted considerable flexibility in using these funds within several broad categories. In New Jersey, local governments used their ARPA-SLFRF allocations to fund projects addressing a variety of needs. As shown in Figure 1 below, approximately 40% of these projects focused on revenue replacement, ensuring continuity of essential services. Another 20% of the projects targeted public health initiatives, while 14% addressed the negative economic impacts of the pandemic. Infrastructure projects accounted for 13% of the funds, with the remaining allocations supporting projects related to administrative needs, natural disasters, premium pay, public sector capacity, surface transportation, and Title I programs.

Figure 1 – Distribution of ARPA-SLRFR Projects in New Jersey by Expenditure Category

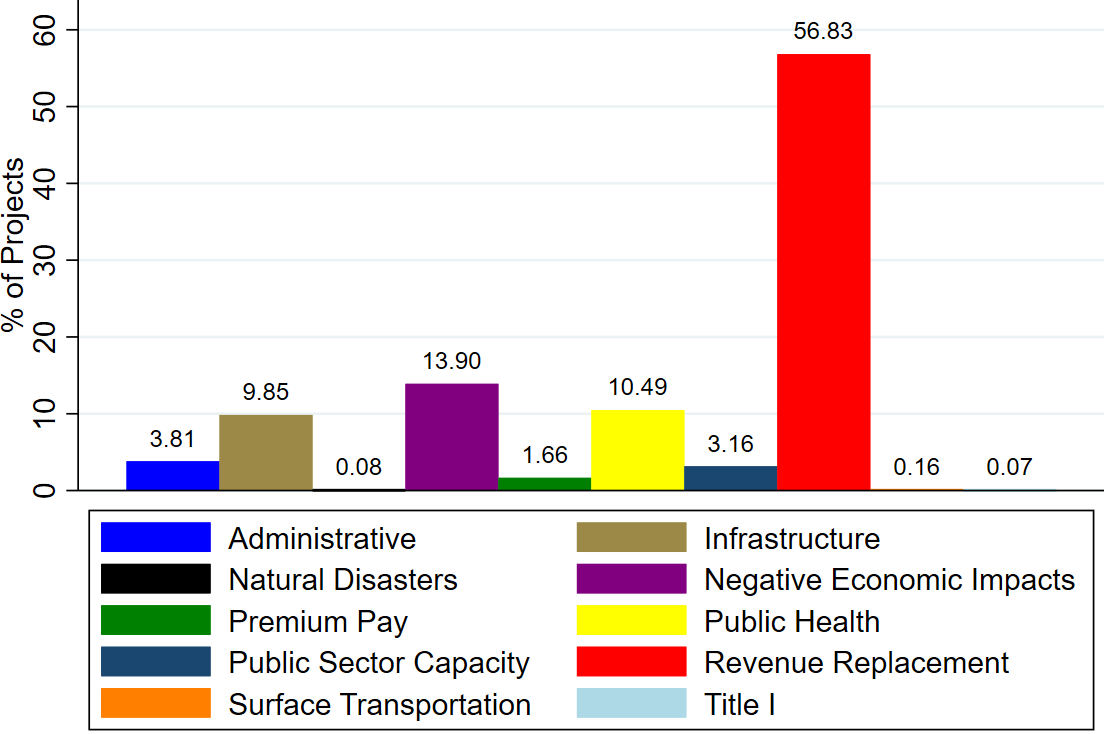

Compared to New Jersey, local governments in other states exhibit similar patterns, though with some slight differences. Specifically, as shown in Figure 2, these governments are, on average, more likely than their New Jersey counterparts to allocate grants for revenue replacement purposes (56.83%) and less likely to focus on public health (10.49%), infrastructure (9.85%), or public sector capacity projects (3.16%).

Figure 2 – Distribution of ARPA-SLRFR Projects in Other States by Expenditure Category

The deadline for local governments to obligate their ARPA-SLFRF funds is December 31, 2024. To assess progress, we examine comprehensive expenditure data reported to the U.S. Treasury Department, focusing on the percentage of funds obligated as of April 2024. Key questions include whether New Jersey local governments have obligated a larger percentage of their funds compared to their counterparts in other states and whether the percentage of funds obligated varies across different tiers of local government. This analysis provides insights into how effectively local governments are utilizing these critical resources within the prescribed timeframe.

Figure 3 below shows that New Jersey local governments have obligated a larger percentage of their ARPA-SLFRF funds compared to their counterparts in other states. As of April 2024, 84% of New Jersey projects’ adopted budget funds have been obligated, compared to 82% for non-New Jersey projects. The most significant disparity is observed among Tier 1 local governments, where nearly 90% of New Jersey Tier 1 projects’ funds have been obligated, compared to only 81% for non-New Jersey Tier 1 governments. Tier 1 local governments are the largest in size with at least 250,000 residents. These differences underscore the varying capacities and priorities across jurisdictions, shedding light on how local governments are progressing toward the December 2024 obligation deadline.

Figure 3 – Percentage of Projects’ Adopted Budgets Obligated by Government Type

Note: According to the reporting data for the State and Local Fiscal Recovery Funds (SLFRF) tracked by the Department of Treasury, local governments reported the amounts obligated and spent on nearly all funded projects. However, they did not report the adopted budget for approximately 42% of projects by March 31, 2024. This figure is based on a sample that excludes projects with missing values of adopted budget.

As the United States prepares for a potential shift in fiscal priorities under a new presidential administration, the findings from this analysis carry important policy implications. A less supportive federal government stance on state and local government finances in the future could heighten the significance of the remaining ARPA-SLFRF funds. These funds could serve as a critical buffer against inflationary pressures, enabling local governments to manage higher costs and continue delivering essential services. Additionally, the prudent use of unspent funds could help mitigate inflation risks by targeting long-term investments rather than immediate consumption. By leveraging these resources strategically, local governments can position themselves to better navigate future economic challenges and ensure fiscal stability in an uncertain policy landscape.

Pengju Zhang is an associate professor at Rutgers-Newark and Michael S. Hayes is an associate professor at Rutgers-Camden.