The COVID-19 pandemic has accelerated changes in investment decisions throughout the economy. For example, the growth in virtual work and e-commerce has likely negatively impacted the demand for some commercial property in New Jersey. A significant increase in vacant and under-occupied property can cause many social problems, including increasing crime in local communities, reducing economic growth, and reducing governmental revenues (Shlay and Whitman 2003; Seo and Von Rabenau 2011; Cui and Walsh 2015). We explore the recent trends in commercial property vacancy rates in New Jersey and identify the potential policy solutions to address this.

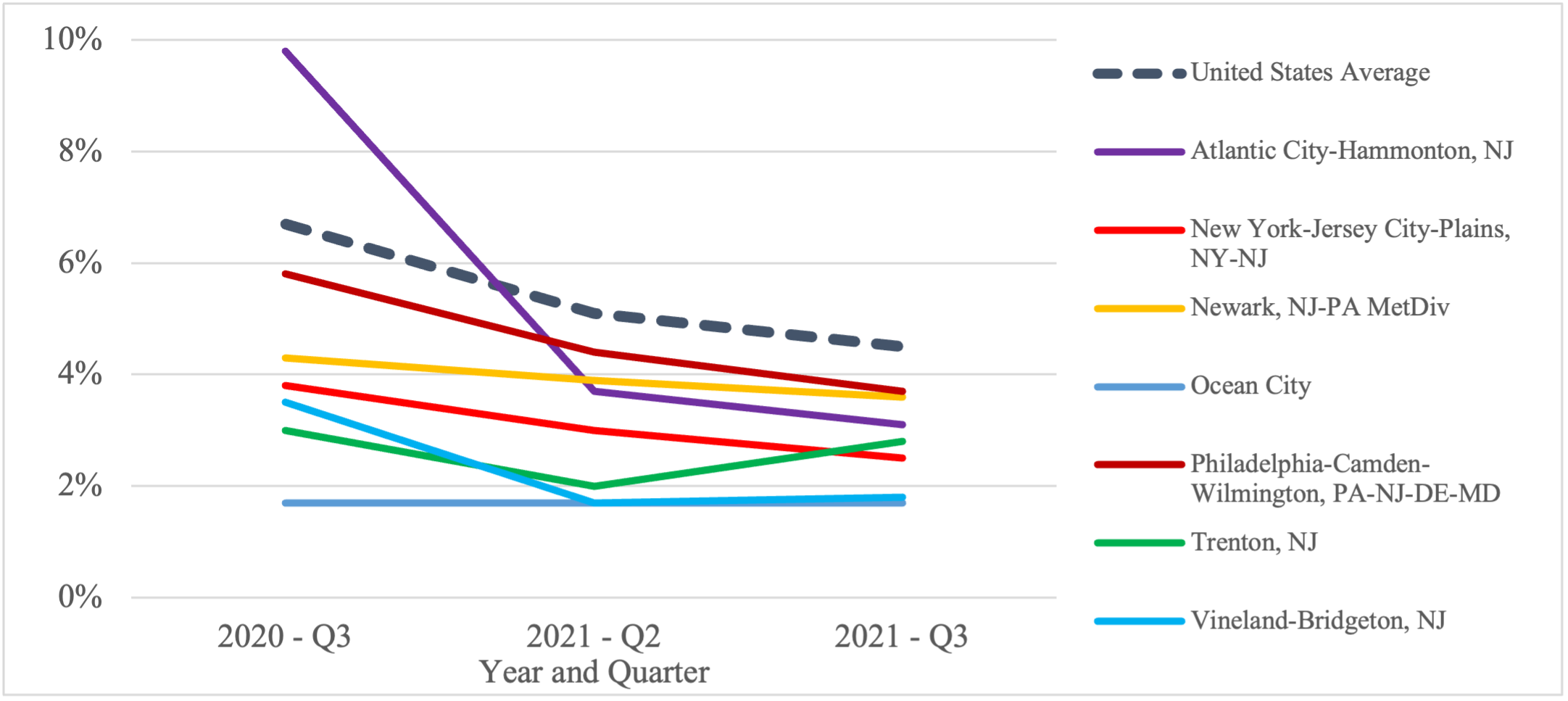

Interestingly, vacancy rates for commercial property in New Jersey are significantly lower than the national average. As shown in Figure 1, all seven New Jersey metropolitan areas had a lower vacancy rate for multifamily commercial properties compared to the national average. Most NJ metropolitan areas have lower than average vacancy rates across all four classes of commercial property: multifamily, industrial, office, and retail. Our in-depth phone call interviews with property tax assessors across New Jersey cities suggest an optimistic view of the current and future demand for commercial property in the state, especially industrial and multifamily commercial properties.

Figure 1. Multifamily Commercial Property Vacancy Rates by Metropolitan Area

Data Source: National Association of REALTORS Research Group

Various factors contribute to vacant and under-occupied properties in central cities, including urban population decline, suburbanization, rise of e-commerce, and speculative investment (Hoylman 2017; McGowan 2019; Talen and Park 2021). Our study adds to the literature by examining whether commercial property owners strategically under-utilize their property to reduce their property tax liabilities. For example, one potential strategy is to “activate the first floor only” of a commercial property building and not leasing out the top floors to potential renters. However, our research suggests this is not a viable business strategy and therefore not an important explanation for vacant and under-occupied properties in New Jersey.

New Jersey local governments need to carefully choose the policy tools that fit best with their local communities. In general, we find that “tax” policies (e.g., property tax surcharges used in Washington D.C.) may not be promising under current New Jersey laws. However, there are several “non-tax” policies that could be implemented, including: vacant property registrations, tax abatements, code enforcement policies, land banks, better case law in tax courts, lower capitalization rates, and better training for tax court judges. For example, Trenton adopted a vacant property registration ordinance that requires all owners of vacant commercial property to register with the city and to pay an increasing annual fee. It is worth mentioning that each of these tools has its own strengths and weaknesses and therefore, a combination of them may better address the vacant commercial property issue.

Note that more details will be available in a forthcoming policy brief, and in the slide deck linked here.

References

- Cui, Lin, and Walsh, Randall. 2015. “Foreclosure, vacancy and crime.” Journal of Urban Economics. 87, 72–84.

- Hoylman, Brad. 2017. “Bleaker on Bleecker.” https://www.nysenate.gov/sites/default/files/press-release/attachment/bleaker_on_bleecker_0.pdf

- McGowan, Jacob. 2019. “How Has the Growth of E-commerce Sales Affected Retail Real Estate?” CMC Senior Theses. 2189. https://scholarship.claremont.edu/cmc_theses/2189

- Seo, Wonseok, and Burkhard von Rabenau. 2011. “Spatial Impacts of Microneighborhood Physical Disorder on Property Resale Values in Columbus, Ohio.” Journal of Urban Planning and Development 137(3): 337–345.

- Shlay, Anne B., and Gordon Whitman. 2003. “Blight Free Philadelphia: A Public-Private Strategy to Create and Enhance Neighborhood Value.” Philadelphia, PA: Temple University Center for Public Policy.

- Talen Emily and Park Jein. 2021. Understanding Urban Retail Vacancy. Urban Affairs Review. doi:1177/10780874211025451